In the rapidly evolving startup ecosystem of the Gulf Cooperation Council (GCC) countries, where economies like the UAE and Saudi Arabia are projected to grow at 4-5% annually through 2025, human resources (HR) metrics have become indispensable for founders navigating the transition from startup to scale-up. As GCC startups face intense competition for talent amid Vision 2030 initiatives and Emiratisation policies, tracking scale-up HR KPIs ensures sustainable growth, optimized performance, and high employee engagement in the Gulf. This article delves into essential HR metrics for GCC startups, backed by recent data and analyses, while highlighting the critical role of HR outsourcing and performance management solutions to drive efficiency and compliance.

The Growing Importance of HR Metrics for GCC Startups

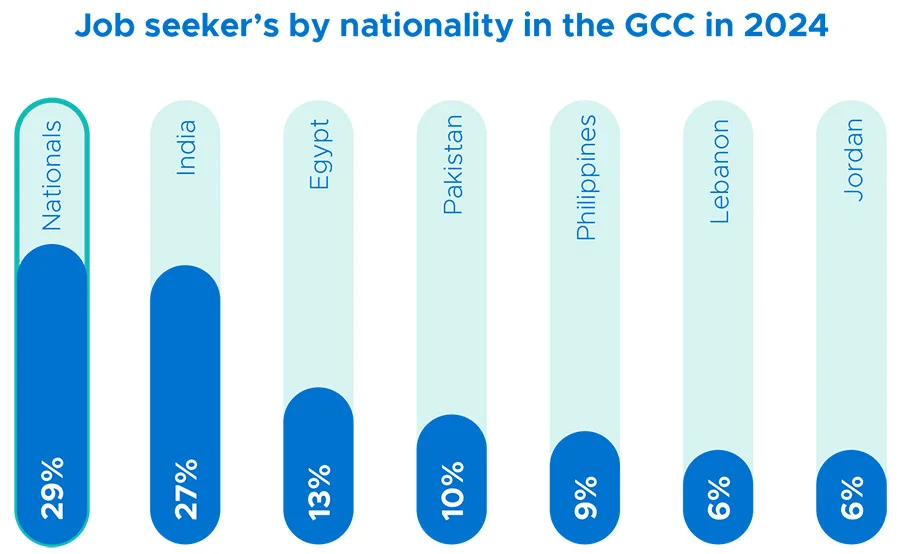

GCC startups are booming, with over 10,000 new ventures registered in the UAE alone in 2024, fueled by tech hubs like Dubai Internet City and Riyadh’s innovation districts. However, scaling up brings challenges: high attrition rates, cultural diversity in expatriate-heavy workforces, and the need for data-driven decisions. According to a 2025 report, 70% of GCC organizations plan to expand headcount, but without robust HR metrics, founders risk inefficiencies that could derail growth. HR metrics GCC startups must track include retention rates in the Middle East, employee engagement in the Gulf, and performance indicators, all aligned with SEO-optimized strategies for talent acquisition and retention.

Essential HR Metrics for GCC Startups

By leveraging these KPIs, startups can benchmark against regional averages—such as the 16.9% overall attrition rate in GCCs for 2024—and identify gaps early. Data from Talent500’s 2025 report shows voluntary attrition at a record low of 12.6%, reflecting improved retention strategies amid salary hikes averaging 9.9%. This underscores how monitoring scale-up HR KPIs can enhance competitiveness in a market where 1 in 5 GCC firms plans workforce expansion in 2025.

Essential HR Metrics for GCC Startups

Key HR Metrics Every GCC Startup Founder Should Track

To thrive, GCC startups must prioritize measurable, actionable KPIs. Below, we analyze the top metrics with 2025 data, formulas, and regional insights.

1. Employee Retention Rate: Combating Turnover in the Middle East

Retention rates in the Middle East are pivotal for scale-ups, where talent churn can cost up to 200% of an employee’s salary in replacement expenses. The formula is: Retention Rate = (Number of Employees at End of Period – Number of New Hires) / Number of Employees at Start of Period × 100

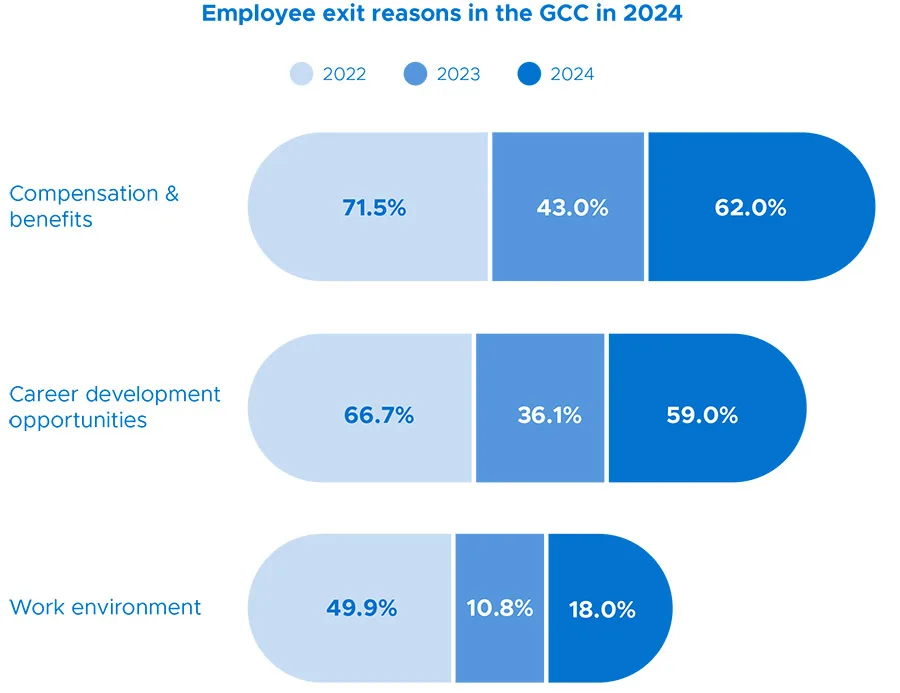

In 2025, GCC startups report an average voluntary attrition of 12.6%, down from previous years due to enhanced engagement programs. Analysis from Procapita Group reveals that high turnover (above 20%) signals deeper issues like poor job satisfaction, particularly in expatriate-dominated sectors. For GCC startups, maintaining rates above 85% is crucial; tech firms in the UAE, for instance, achieve this through AI-driven predictive analytics, reducing flight risks by 15-20%. Low retention erodes institutional knowledge, but data shows companies investing in upskilling see 37% higher retention, aligning with Saudi Arabia’s Vision 2030 focus on national talent development.

2. Employee Engagement Score: Boosting Productivity in the Gulf

Employee engagement in the Gulf remains a challenge, with only 30% of UAE employees feeling engaged at work per Gallup’s 2025 data. Globally, engagement hovers at 21%, but GCC startups lag due to cultural and remote work dynamics. Measure via: Engagement Score = (Sum of Survey Responses / Total Possible Score) × 100 or tools like eNPS (Employee Net Promoter Score).

A 2025 study on GCC organizational culture shows 52% of nationals report high engagement, driven by inclusive policies. Analysis indicates engaged teams are 31% more productive, per Harvard Business Review, yet disengagement costs the UAE economy up to $10.3 billion annually. For startups, integrating DEI initiatives—tailored to the region’s expatriate workforce—can lift scores by 20%, fostering loyalty amid 2025’s digital nomad trends.

3. Time to Hire and Cost per Hire: Streamlining Recruitment for Scale-Ups

Scale-up HR KPIs like Time to Hire (average days from posting to acceptance) average 45-60 days in GCC startups, impacted by visa processes. Cost per Hire, calculated as Total Recruitment Costs / Number of Hires, ranges from AED 15,000-25,000 in the UAE.

With 70% of GCC firms expanding in 2025, analytics-driven hiring is key; data shows AI tools reduce time by 30%. High costs signal inefficiencies, but outsourcing can cut them by 40%, allowing founders to focus on core innovation.

4. Training ROI: Investing in Talent Development

Training ROI = (Benefits – Costs) / Costs × 100. In GCC, startups investing in skills see 37% higher retention, with 2025 trends emphasizing AI upskilling amid a 17.5% CAGR in employee engagement software markets. Government subsidies under Vision 2030 amplify ROI, making this metric essential for long-term scale-up success.

Analyzing HR Trends in the GCC: Data-Driven Insights for 2025

The GCC HR tech market is set to grow at 10.26% CAGR through 2033, driven by AI-powered analytics. Trends show a shift to data-driven HR, with 85% of Middle Eastern businesses investing in tech for retention and engagement. However, challenges persist: Tech turnover averages 20% annually, per SHRM, necessitating proactive metrics tracking. Startups leveraging these insights—such as predictive HR analytics—reduce attrition by forecasting risks, aligning with the region’s focus on innovation and sustainability.

The Importance of HR Outsourcing for GCC Startups

For resource-strapped GCC startups, outsourcing HR is a game-changer, reducing costs by 20-40% and enabling focus on growth. In 2025, with complex labor laws and nationalization quotas, outsourcing provides expertise in compliance, payroll, and talent acquisition at a fraction of in-house costs—ideal for SMBs. Benefits include scalability, as startups grow from 10 to 100 employees, and access to specialized skills like AI recruitment. Data from Procapita shows outsourced solutions enhance strategic HR planning, boosting retention by 15% through data analytics. Ultimately, outsourcing transforms HR from a cost center to a value driver, crucial for GCC scale-ups navigating economic diversification.

Performance Management Solutions Tailored for GCC Startups

Performance management solutions in the GCC, like cloud-based HRMS platforms (e.g., IBIZ HRMS in Dubai), integrate KPIs for real-time tracking, ensuring compliance with local laws. Tools such as Entomo or Zimyo M.E. automate goal setting and feedback, with AI reducing bias in appraisals. In 2025, these solutions drive a 10-15% productivity uplift, per Statista, by aligning metrics with strategic goals. For startups, adopting such systems—often via outsourcing—ensures cultural fit and high performance in diverse teams.

Conclusion: Empowering GCC Startups Through Data and Strategy

Tracking HR metrics GCC startups need—from retention rates in the Middle East to employee engagement in the Gulf—is vital for scaling sustainably in 2025’s dynamic landscape. Supported by outsourcing and advanced performance management solutions, founders can turn data into actionable insights, fostering a resilient workforce. As the GCC HR tech market surges, prioritizing these KPIs will not only mitigate risks but propel startups toward long-term success. For tailored advice, explore resources like Procapita or Gallup reports to benchmark your progress.